Our Approach

We’re uniquely positioned to access full-cycle opportunities across the capital stack.

Why Commercial Real Estate (CRE)?

We believe CRE offers favorable, risk-adjusted returns, with debt risk characteristics and benefits.

Our Offerings

Providing access to commercial real estate debt at a critical time for today’s investors.

Supporting Material

Busting the Bias Against US Securitized

Get more insights into the complex world of CMBS from Head of U.S. Securitized Products at Janus Henderson, John Kerschner, as he seeks to identify and debunk the biases that keep some investors from considering an allocation to U.S. securitized fixed income in his 2024 outlook.

Material by Janus Henderson Investors, sub-adviser for Forum Real Estate Income Fund.

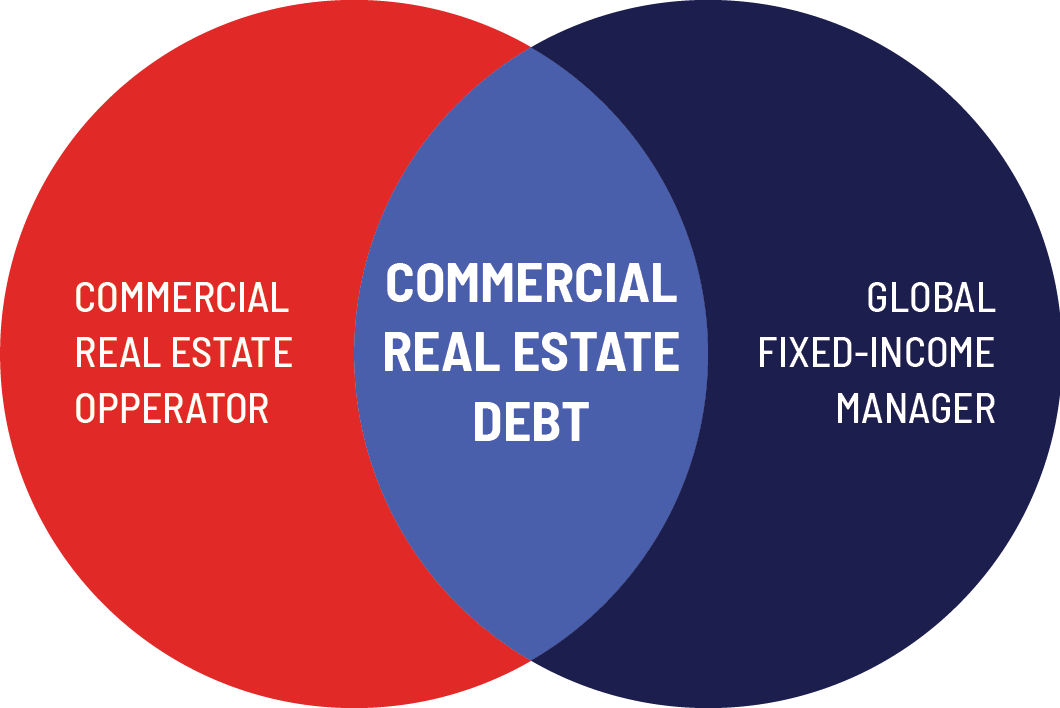

Seasoned, cross-disciplinary and ready to seize opportunity.

We’ve combined the expertise of our in-house direct real estate owner/operator platform with that of a large, global fixed-income manager to offer access to commercial real estate debt investments—a market typically only available to large insurance companies, pension plans and hedge funds.

Real estate sourcing through a nationwide partnership network

Seasoned owner/operator mentality for property-level due diligence

Shared services support from experienced, cross-disciplinary team

Institutional sourcing with "early look" at attractive opportunities

Operational and trading expertise

Global footprint with a team of seasoned fixed-income analysts and professionals

Current income:

CRE attempts to offer quarterly cash flows with historically low volatility* relative to traditional fixed-income investments.

Capital preservation:

Investing across the entire commercial real estate capital stack may offer safer debt investments backed by high-quality

collateral.

Market opportunity:

Flexible investment mandate that can shift allocations to take advantage of market dislocation.

FORUM CAPITAL ADVISORS – OUR TEAM:

IMPORTANT INFORMATION

This material is provided for informational purposes only and is not intended as and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Forum Capital Advisors, LLC or its affiliates ("Forum"). Past performance is not indicative of future results. Private market investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in a private market investment entails a high degree of risk and no assurance can be given that any private market investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and Forum assumes no liability for the information provided.

Securities may be offered through Foreside Financial Services LLC, a registered broker-dealer member of FINRA.

Past performance is not a guarantee nor a reliable indicator of future results. As with any investment, there are risks. There is no assurance that any portfolio will achieve its investment objective.