FREIF’s Investment Objectives

- Maximize current income

- Preserve investor capital

- Realize long-term capital appreciation

The Power of Partnership

FREIF benefits from two of the industry’s experienced investment advisers to source, evaluate, and monitor the Fund’s institutional real estate securities.

Investment Adviser

Forum is a private real estate investment manager focused on multifamily with an owner/operator mentality and experience in development, acquisitions, and lending.Sub-Adviser

Janus Henderson’s mission is to help clients define and achieve superior financial outcomes through differentiated insights, disciplined investments, and world-class service.Portfolio Summary

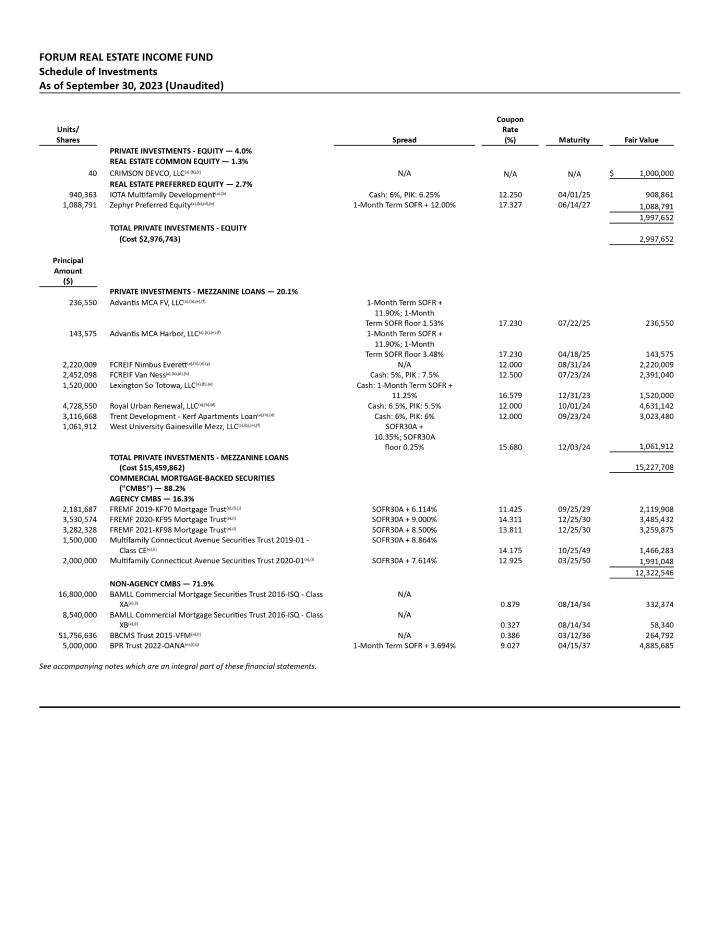

Fund Allocation by Investment Type

(as of February 28, 2025)Fund Allocation by Sector

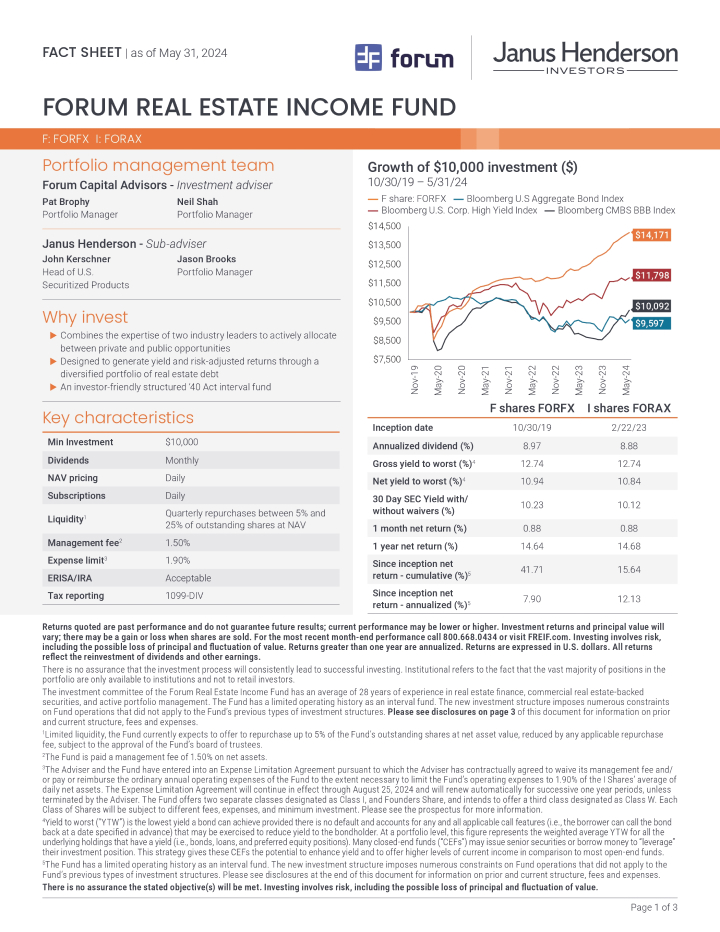

(as of February 28, 2025)Growth of a $10,000 Investment (as of February 28, 2025)

Past performance is not a guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns are calculated using the traded NAV as of the date of this table (above). The performance is based on average annual returns.

Fund Performance vs. Benchmarks (as of February 28, 2025)

FORAX Since Inception Net Return (Cumulative) is 25.41% and Since Inception Net Return (Annualized) is 11.89%. Inception date was 02/22/2023.

FORBX Since Inception Net Return (Cumulative) is 6.36% and Since Inception Net Return (Annualized) is N/A. Inception date was 07/17/2024.

Past performance is not a guarantee of future results. The performance data quoted represents past performance and current and future returns may vary. Total net return figures include change in share price, reinvestment of dividends and capital gains, net of fees and expenses. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. For the most recent performance, please call 888-267-1456 or email InvestorRelations@ForumIG.com. Please refer to the important disclosures at the end of this presentation for a description of benchmarks. Dividends are not a direct reflection of fund performance. The Fund can pay dividends from any source, including income and realized gains. The Fund’s dividend proceeds may exceed its earnings, in which case portions of dividends that the Fund makes may be a return of money that Shareholders originally invested.

Simplicity of Access

Direct exposure to institutional real estate debt securities.

Broad investor

suitability

CUSIP /

Ticker access

F Share: FORFX

I Share: FORAX

K Share: FORBX

F Share: FORFX

I Share: FORAX

K Share: FORBX

1940-Act registered, continuously

offered closed-end interval fund

Daily valuation, target quarterly tender offers

Low investment minimums

1099 tax reporting

Taxed as a REIT

Why Forum’s Income Fund?

-

Strong Partnership

Combines two of the industry’s experienced investment advisers to source, evaluate, and monitor the Fund’s institutional real estate securities. -

Balanced Income & Volatility

Designed to generate yield and risk-adjusted returns through a diversified portfolio of real estate debt that has historically exhibited low correlation to the broader market. -

Access

An investor-friendly structured ’40-Act interval fund, providing access to traditionally institutional assets and hard-to-replicate investments. -

Simplicity

Convenient CUSIP/ticker symbol (FORAX) product available on Fidelity, Schwab, Axos, and Pershing platforms.

Fund Resources

Prospectus

Read More

Statement of Additional Information

Read More

Fact Sheet

Read More

Brochure

Read More

Pitch Book

Read More

Annual Report (December 31, 2024)

Read More

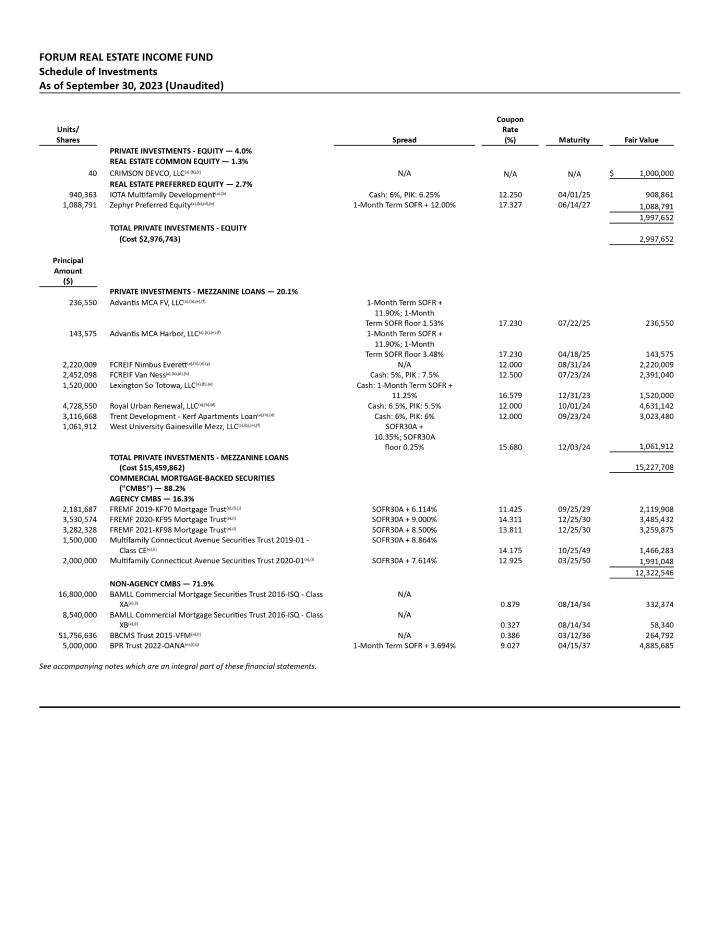

Quarterly Holdings (September 30, 2024)

Read More

Semi-Annual Report (June 30, 2024)

Read More

Quarterly Holdings (March 31, 2024)

Read More